Morgan Stanley is making a minimum of 50% features on these two shares — here is why they’re so excessive

It’s now clear that we noticed the market on the lows of final October. the Standard & Poor’s 500 It’s up about 1,000 pips, or ~27%, from that low. The query for traders now could be, what occurs subsequent?

Mike Wilson, the well-known strategist from Morgan Stanley, has a fame as the last word bear, however he backtracked on that on a latest word. “The info now we have immediately means that we’re in a late policy-driven restoration cycle,” says Wilson. He goes on to notice a number of supportive components, together with low inflation, a slowdown within the Fed’s tightening coverage, and the broad consensus that the latest fee hike, of 25 foundation factors, was the final on this tightening cycle – and that the Fed will flip Fed towards simpler cash later this yr.

Wilson additionally attracts consideration to the similarities between present circumstances and 2019, the final time the Fed pushed financial easing, noting that “the 2019 analogy itself suggests additional upside from right here.”

Trying forward, Wilson believes we’re on to features as 2023 attracts to an in depth, and his fellow fairness analysts at Morgan Stanley are taking that concept and working with it. The corporate’s analysts decide shares with “extra upside forward,” and so they’ve flagged a few shares they really feel will rise 50% or higher from their present ranges. Let’s take a more in-depth look.

Altus Energy (Ampere)

Morgan Stanley’s first licensed identify takes us into the utility sector, with Altus Energy working within the photo voltaic enterprise. The photo voltaic power sector as an entire has acquired a political increase from the Biden administration, one which was codified by the inflation-reducing regulation signed into regulation final yr. Altus is a customer-focused firm that delivers photo voltaic installations for industrial, industrial and neighborhood use all through the US. The Connecticut-based firm has operations within the higher Mississippi Valley, within the Southeast, and Southwest, however the bulk of its operations are within the Northeast and in California.

Along with photo voltaic power installations, Altus supplies power storage and electrical car charging companies. The corporate prides itself on every set up being tailor-made to particular buyer wants; Its enterprise operations are designed to attract the consumer into the venture improvement course of with a purpose to streamline licensing, building and commissioning processes, whereas its neighborhood operations concentrate on sustainable and renewable choices to offer clear power to residents. Altus boasts that it has put in greater than 4.55 billion kilowatt-hours of photo voltaic power since 2009.

Altus will report its Q2 ’23 outcomes later this month, however a glance again at Q1 and the months since can be revealing. The corporate reported income of $29.4 million for the primary quarter, up 53% year-over-year. The corporate’s web revenue, as measured by GAAP, was 3 cents, beating estimates by about 6 cents. The corporate claimed a complete portfolio of about 686 MW of energy era, a complete of 8 MW accomplished in April and Might.

This brings us to one in all Altus’ key strengths: the corporate’s dedication to repeatedly increasing its community. Since saying first-quarter outcomes, Altus additionally introduced the acquisition of 4.4 megawatts of energy era amenities in California, including to that state’s complete portfolio of 112 megawatts. Additionally in July, Altus introduced that it had added a brand new 10 MW photo voltaic system in addition to a 15 MWh battery storage system to its Massachusetts property. Altus now operates in 25 states.

With Altus’ protection of Morgan Stanley, analyst Andrew Percocco sees the corporate’s neighborhood amenities as a novel asset on which to construct for additional progress.

“Whereas AMPS is commonly pegged as a rooftop C&I developer, and it’s true, it doesn’t absolutely seize the broader market alternative, which incorporates neighborhood photo voltaic (24% of current portfolio). Whereas the neighborhood photo voltaic market is small immediately, it presents A novel alternative for the corporate to leverage rooftop and floor entry from C&I prospects to offer clear, reasonably priced energy to residential prospects who don’t have the power so as to add rooftop photo voltaic,” Percoco opened.

“Based mostly on our calculations, we see extra upside alternatives than draw back dangers for the Firm’s 2023 steering – word that the Firm exited 2022 with roughly $79 million in EBITDA per yr and after accounting for its acquisition of True Inexperienced, Which we estimate provides $17 to $19 million of contracted EBITDA in 2023, which places the corporate inside attain of its minimal steering, earlier than contemplating the extra property it places into service this yr,” the analyst added.

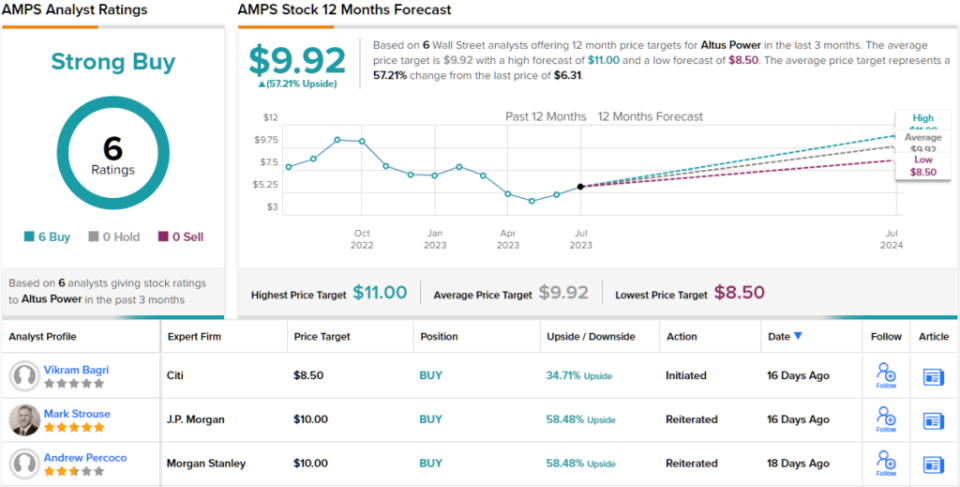

To that finish, Percoco assigns an chubby (i.e. purchase) score on AMPS, in addition to a $10 worth goal indicating its confidence in a possible 58% one-year upside. (To see Percoco’s observe report, click here)

Total, this solar energy firm has a Sturdy Purchase consensus score, primarily based on 6 lately assigned optimistic analyst evaluations. Altus shares are buying and selling at $6.31, and the common worth goal of $9.92 implies a 57% upside in retailer for the following 12 months. (be seen AMPS stock forecast)

United Airways Holdings (UAL)

Morgan Stanley’s subsequent decide is United Airways, one in all America’s oldest airways—and by some measures, the most important airline on the earth. The corporate presents extra out there seat miles than every other airline, but it surely ranks third in complete fleet measurement, with 893 plane in operation. That would quickly change, as of final December, United positioned an enormous order with Boeing for 100 787 Dreamliner wide-body airliners — and an possibility to purchase 100 extra sooner or later.

United actually has the infrastructure to increase its fleet. The corporate operates from a number of hubs in the US—at main areas similar to Chicago, Denver, Houston, Los Angeles, San Fran, New York/Newark, and D.C.—and flies practically 5,000 routes every day to greater than 342 areas on six continents. Amongst North American air carriers, United has probably the most intensive world route community.

The corporate has clearly benefited in latest quarters from the overall post-COVID financial restoration. Individuals wish to journey, and they’re doing so now that pandemic restrictions have been lifted. United has seen its quarterly earnings present a constant year-over-year acquire for the reason that begin of 2022.

The latest reported quarter, 2Q23, was no exception. The corporate’s web revenue of $14.2 billion was up greater than 17% year-over-year, and beat expectations by greater than $250 million. On the underside line, United reported a powerful non-GAAP incomes of $5.03, which was 97 cents forward of estimates. Maybe the very best gauge for traders is steering for full-year adjusted earnings per share — United expects earnings of $11 to $12 per share for the complete yr 2023 in comparison with consensus forecasts of $9.65.

The latest earnings caught the eye of Morgan Stanley analyst Ravi Shanker, who wrote of United, “UAL has lengthy been the consensus for the airline group year-to-date, and the 2Q rating, convention name feedback, and outlook gave no motive to dampen that enthusiasm.” The most important shock was PRASM’s “related or barely higher” home commentary for Q3 which is a lot better than the friends. Maybe this displays barely completely different formulations or only a higher combine in UAL however both manner, it modifications the story of UAL being an “worldwide solely” story The upheaval in late June stored the tempo and the rally even greater, but it surely’s set for a better comp for 2024 — if UAL can get previous its long-term bottlenecks in Newark.”

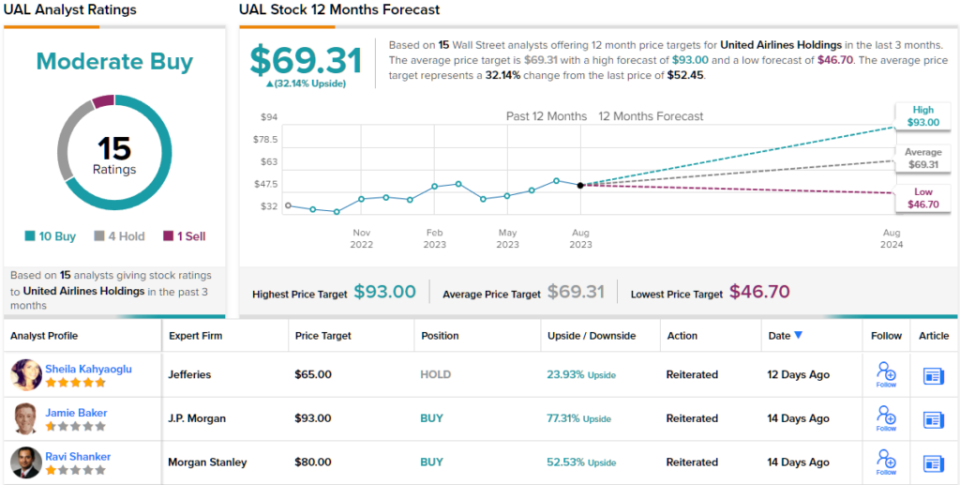

Monitoring this ahead, Shanker charges the inventory as Obese (i.e. Purchase), with a 1-year worth goal of $80, indicating a acquire of 52% from present ranges. (To observe Shanker’s report, click here)

Total, United picked up 15 latest Wall Avenue analyst rankings that embody 10 Purchase, 4 Maintain, and 1 Promote to provide the inventory a Average Purchase consensus score. Shares are promoting for $52.42 and the common worth goal of $69.31 implies a 32% upside within the one yr horizon. (be seen UAL stock forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Best stocks to buya software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather essential to do your individual evaluation earlier than making any funding.